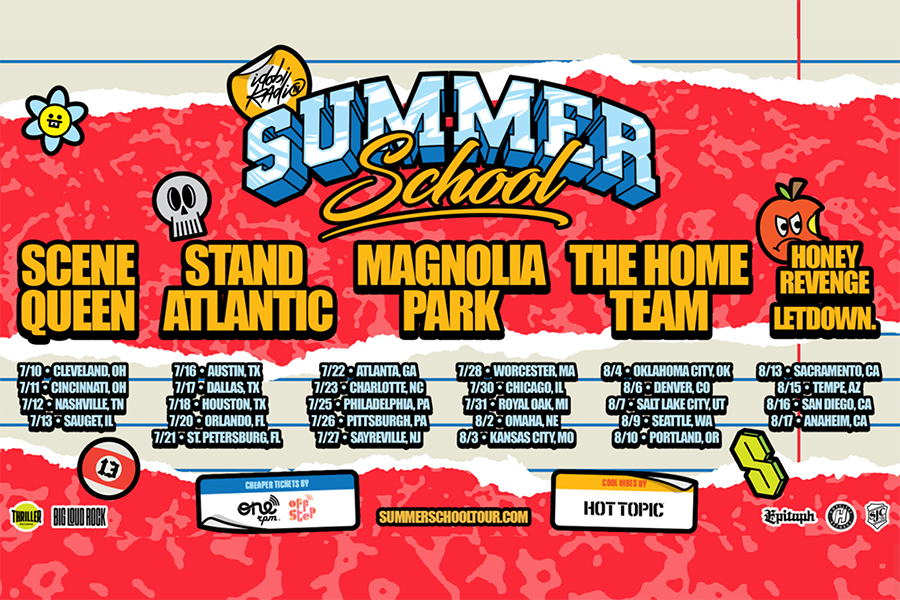

The NY Post reports that Citigroup is close to the sale of record company EMI. The deal reportedly splits the company in to, with recording artists going into one, and it’s publishing arm sold separately in a deal estimated between $3.3 to $3.5 billion.

The NY Post reports that Citigroup is close to the sale of record company EMI. The deal reportedly splits the company in to, with recording artists going into one, and it’s publishing arm sold separately in a deal estimated between $3.3 to $3.5 billion.

Negotiations to sell the more valuable piece, the publishing company, for around $2 billion are said to be taking place with BMG Rights Management, co-owned by New York private equity firm KKR and Bertelsmann, the German media company.

Citigroup is expected to announce next week its plan to sell EMI, home to Katy Perry, in two pieces–publishing and recording–and could name the leading bidder for both parts.

Several sources believe BMG Rights is the preferred bidder because its funding is secure and unlike Sony Corp, it isn’t hampered by anti-trust issues. However, sources insist that Sony is still in the running.

Sony wants publishing to bolster its Sony/ATV unit. Its bid is backed by Indian sovereign fund Mubadala and investment firm Raine, though it is still having trouble finalizing its funding.

Separately, Sony is also reportedly interested in buying Ericsson out of its 50 percent interest in the Sony Ericsson phone giant.

On the recorded music side, Citigroup is negotiating hard with two parties. The widely presumed lead bidder, Warner Music Group’s owner Access Industries, is owned by Russian-born billionaire Len Blavatnik. The other contender is Vivendi’s Universal Music Group.

Blavatnik, sources said, issued an ultimatum to Citi on Oct. 14, saying that he would pull out if a decision wasn’t made soon. Many waved off that report as posturing, given the cost savings of putting Warner and EMI together.

If Blavatnik is victorious, it would, for practical purposes, leave three players with equal pieces of the worldwide music business: Universal, Sony and Warner-EMI.

Citi may yet opt for a deal with Universal, though the firm has been particularly loath to take on EMI’s large pension liabilities. The bidding for the recorded division is said to be in the $1.3 billion to $1.5 billion range.

Citigroup had hoped to command somewhere closer to $4 billion, but the poor debt markets led to difficulties securing funding for a host of private-equity firms who fell away.

Platinum Equity and Apollo had taken an initial interest in the company as had supermarket magnate Ron Burkle and Spotify backer Sean Parker, who discussed teaming up with Sony Music for a bid early on. Warner Music Group, by comparison, was sold by a PE group for $3.3 billion and attracted a host of bidders.

Meanwhile, one hotly debated topic is the future of current EMI Chief Executive Officer Roger Faxon. Some believe that he could land at BMG Rights, running its rapidly expanding music publishing empire. The firm just closed on another acquisition, Los Angeles-based Bug Music.

Faxon could just as easily land at Warner or choose to exit with a handsome pay-out.

Separately, the newly appointed chairman and CEO of Bertelsmann, Thomas Rabe, is said to be headed to New York next week. Sources say Rabe is keen on rebuilding the firm’s standing in the global media business.

Citigroup had no immediate response. Label reps declined comment.